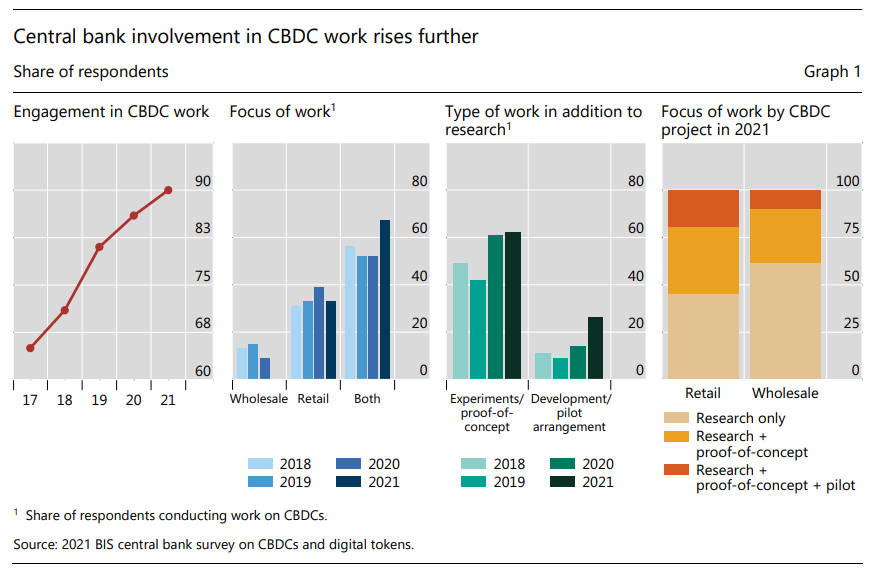

Nine out of 10 central banks are exploring central bank digital currencies (CBDCs), and more than half are now developing them or running concrete experiments, according to the latest BIS survey. In particular, work on retail CBDCs has moved to more advanced stages.

Most central banks are exploring central bank digital currencies (CBDCs), and more than a quarter of them are now developing or running concrete pilots. This BIS paper updates earlier surveys that asked central banks about their engagement in this area.

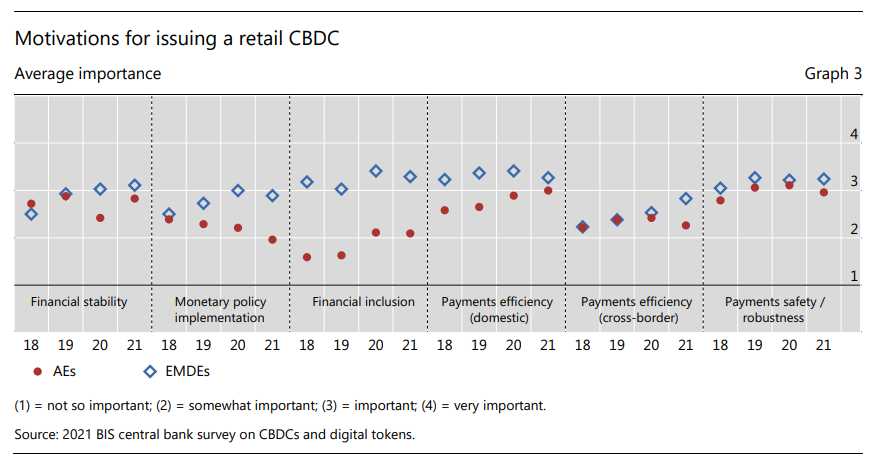

The latest responses from 81 central banks show that the Covid-19 pandemic and the emergence of cryptocurrencies have accelerated the work on CBDCs – especially in advanced economies, where central banks say that financial stability has increased in importance as a motivation for their CBDC involvement.

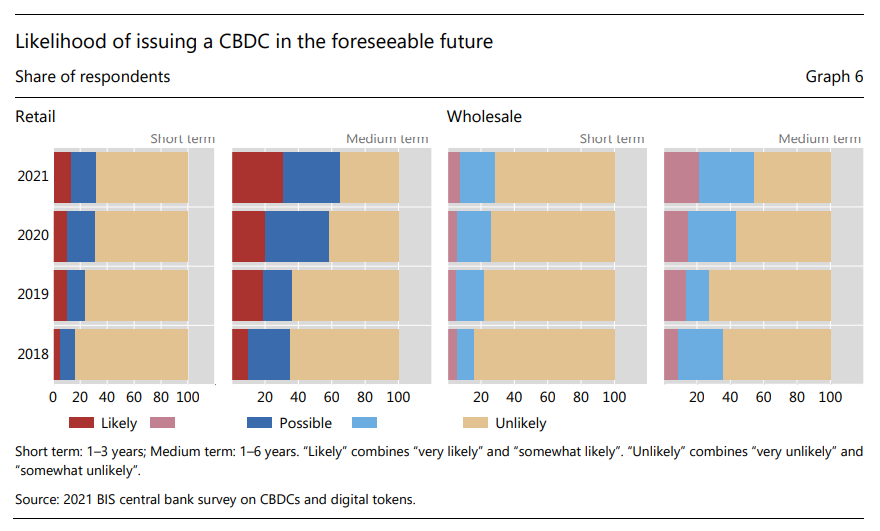

In addition, this paper shows that more than two thirds of central banks are likely to issue a retail CBDC in the short or medium term. Many are exploring a CBDC ecosystem that involves private sector collaboration and interoperability with existing payment systems.

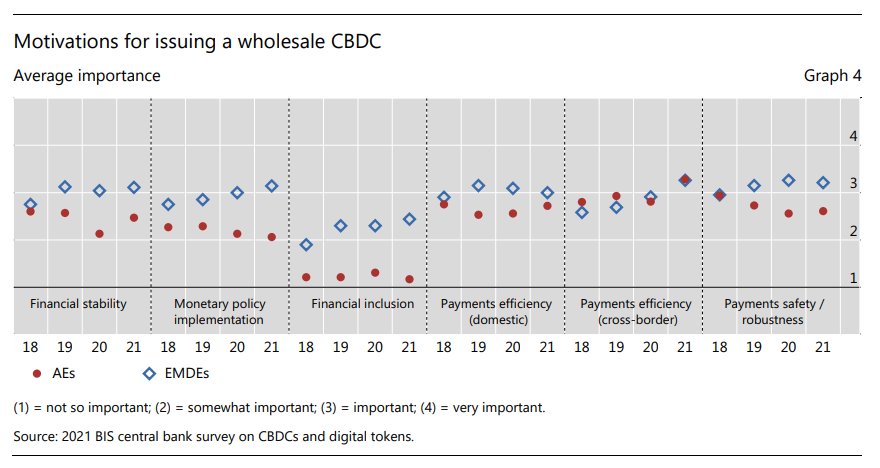

Work on wholesale CBDCs is increasingly driven by reasons related to cross-border payments efficiency. Central banks consider CBDCs as capable of alleviating key pain points such as the limited operating hours of current payment systems and the length of current transaction chains.

Central banks in The Bahamas, China, the Eastern Caribbean Currency Union and Nigeria have issued or are piloting a live retail CBDC, and it is likely that other jurisdictions will follow in the foreseeable future: about 68% of central banks consider that they are likely to or might possibly issue a retail CBDC in the short or medium term. As in previous years, this likelihood is generally higher for EMDE central banks than for AE central banks. The share of central banks considering issuance of a retail CBDC is considerably larger than last year. In particular, the share of central banks planning on doing so in the medium term grew from 58% last year to 65%.

More details: Gaining momentum – Results of the 2021 BIS survey on central bank digital currencies