an article written by Dilip Ramachandran

When I was leading the product team at Bond, my vision was to significantly lower the barrier to entry for brands to embed financial services into their products.

What does this mean?

Imagine you are a product manager at Nike, responsible for the online e-commerce store. What are the ways you could increase sales and distribution of footwear products? Common answers might be:

-

NPI (new product innovation): Special edition sneakers using new technology or designs. e.g., Nike Go FlyEase Easy On/Off Shoes. Nike.com

-

Partnerships: Work with a famous persona, such as Michael Jordan, to release a specialized line of shoes. e.g., New Jordan Shoes. Nike.com

-

Personalization: Offer the product in different styles and colors. You might also have more diversity in your models to attract a broader range of demographics.

-

Marketing: Techniques such as viral promotions, discounts, limited editions, co-brand marketing, and so on. The list is limitless.

My theory was that there was a >$20BN opportunity for large brands such as Nike to offer financial services to their loyal customers.

Imagine this, a lucky teenager is gifted their first pair of Air Force 1’s, and inside the box is a QR code to create a Nike wallet. The pair of shoes comes with a checking account, and she gets rewarded through the Nike app for having good financial habits. And those rewards could be used to buy her next pair of shoes.

It has been two years since that vision was dreamed of, and we are still far from achieving it.

For that product manager at Nike, despite the accessibility of APIs and integration times now as short as a couple of weeks, these kinds of projects just don’t get prioritized.

How about FinTech startups and tech-enabled innovators? I want to spend the rest of the article exploring my journey trying to use BaaS (after years of being on the building side).

Here are some concerns faced by founders considering using a BaaS provider.

-

Regulatory Scrutiny: One BaaS provider has stopped onboarding new customers because one of its partner banks is undergoing regulatory scrutiny.

-

Running out of Cash: As FinTech funding has dried up, some BaaS providers have struggled. Some have been forced to make workforce reductions and manage their expenses to extend the runway.

-

Lack of Differentiation: Behind all the marketing, it is hard to differentiate between most BaaS providers. Unique API endpoints have not been created yet – as they are wrapping other point solutions such as KYC providers, processors, and funding protocols. Unless the BaaS providers specialize in a certain financial product type, they’re on the road to commodity.

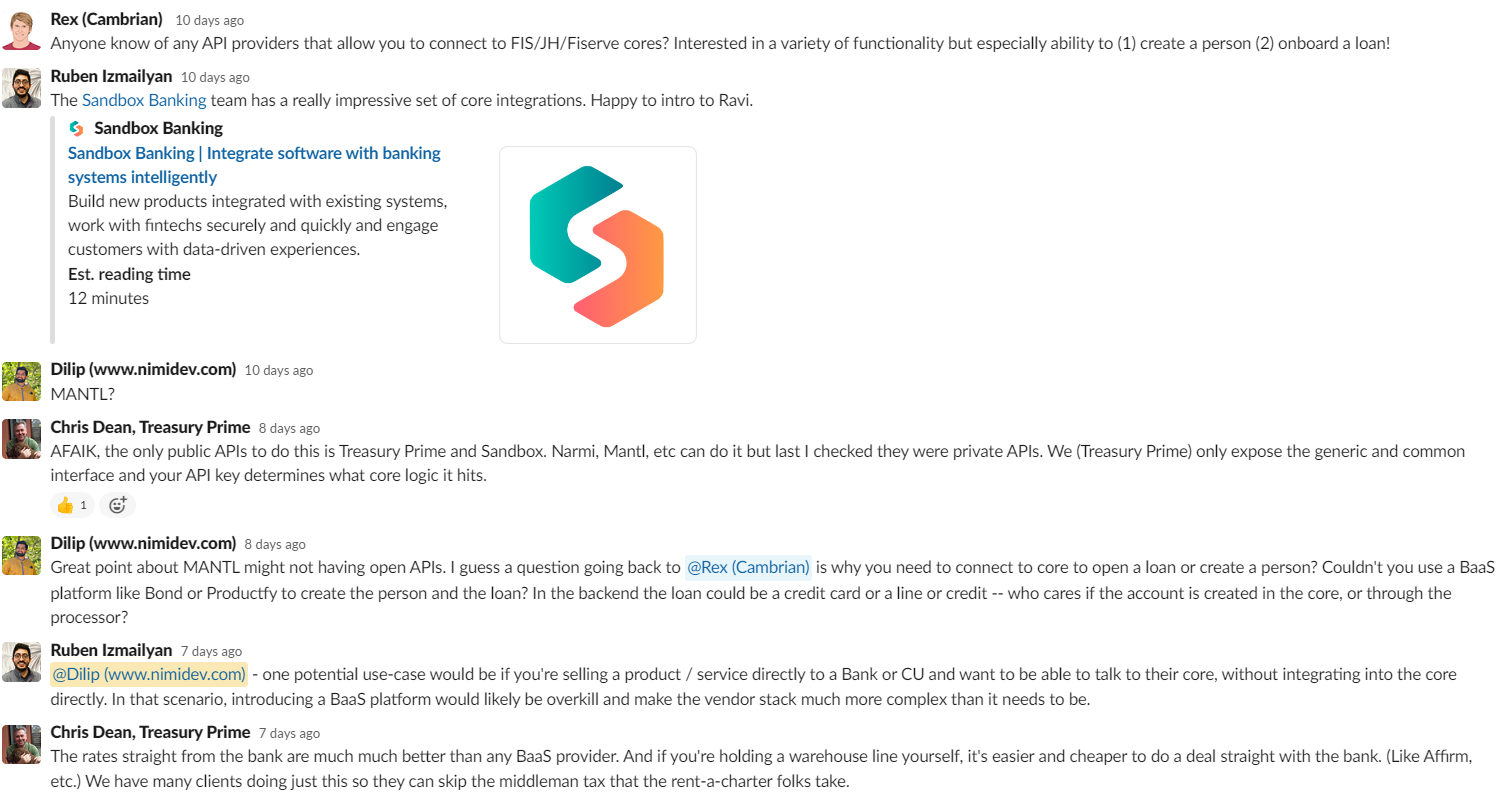

So as a founder, do you BaaS or not? Depends on what you’re building. If you’re creating tools/services for the banks themselves, as described in the thread below, you might be best served to go directly to a bank.

As a founder, if you’re building a consumer or B2B FinTech product, you can’t necessarily go to the bank as they might not be fast enough or capable of serving you.

This is the BaaS sweet spot – speed to market and various financial products under a single, developer-friendly API. Let’s explore this further.

Read the full article here