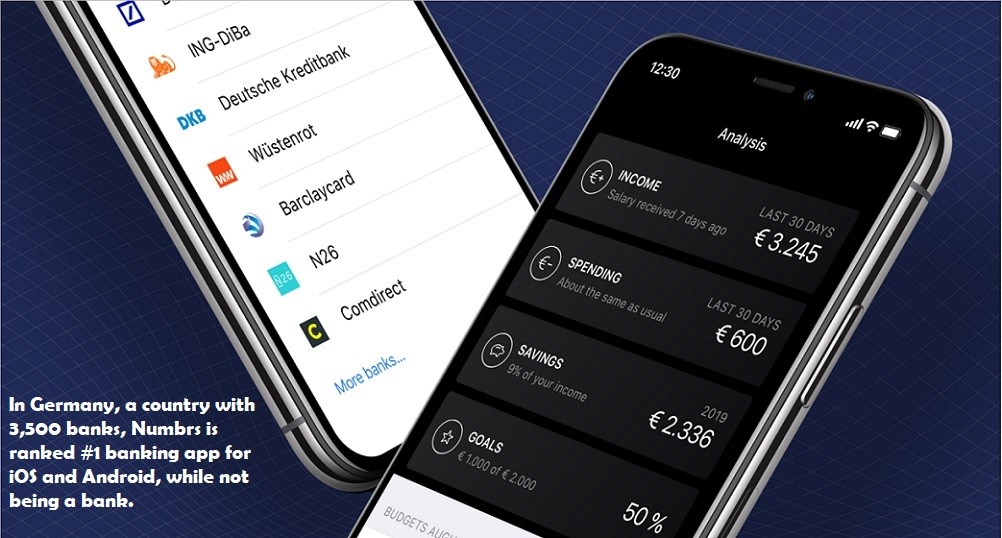

A Zurich-based fintech firm has raised additional money to value the company at more than $1 billion as it prepares to expand outside its main market of Germany. Numbrs Personal Finance raised $40 million to bring the total capital invested to almost $200 million. Numbrs offers an app that enables users to manage their existing bank accounts in one place and to buy financial products. „We have recently raised an […]